- State of the Screens

- Posts

- Social Video Is About to Invade TV

Social Video Is About to Invade TV

In 2012, Snapchat launched vertical video.

I remember thinking it was clever for phones, but it felt like a toy. Something that would live and die in the mobile world, far away from TV’s big screen.

Then came Vine.

For a moment, it looked like a spark. Six-second fireworks that burned bright and fast. And then it disappeared, which only reinforced the idea that mobile video was a sideshow, not the main event.

But small things have a way of compounding.

A habit forms here. A swipe becomes routine. A new format feels trivial until it quietly rewires how people expect to be entertained.

By 2018, TikTok wasn’t just another app.

It was a new idea. Its algorithm fed you exactly what your brain didn’t know it wanted. A stream of hyper-niche content delivered at the speed of instinct.

And suddenly, the thing that once felt like a toy started reshaping the entire attention economy, including TV.

The lesson is simple. The future rarely announces itself. It usually starts as something you underestimate.

Let’s break it down into 5 big questions:

1) Who has the most users?

2) How much social time is video?

3) Where does social video sit in the ad market?

4) Who has the biggest video ad business?

5) What happens next?

Who has the most users?

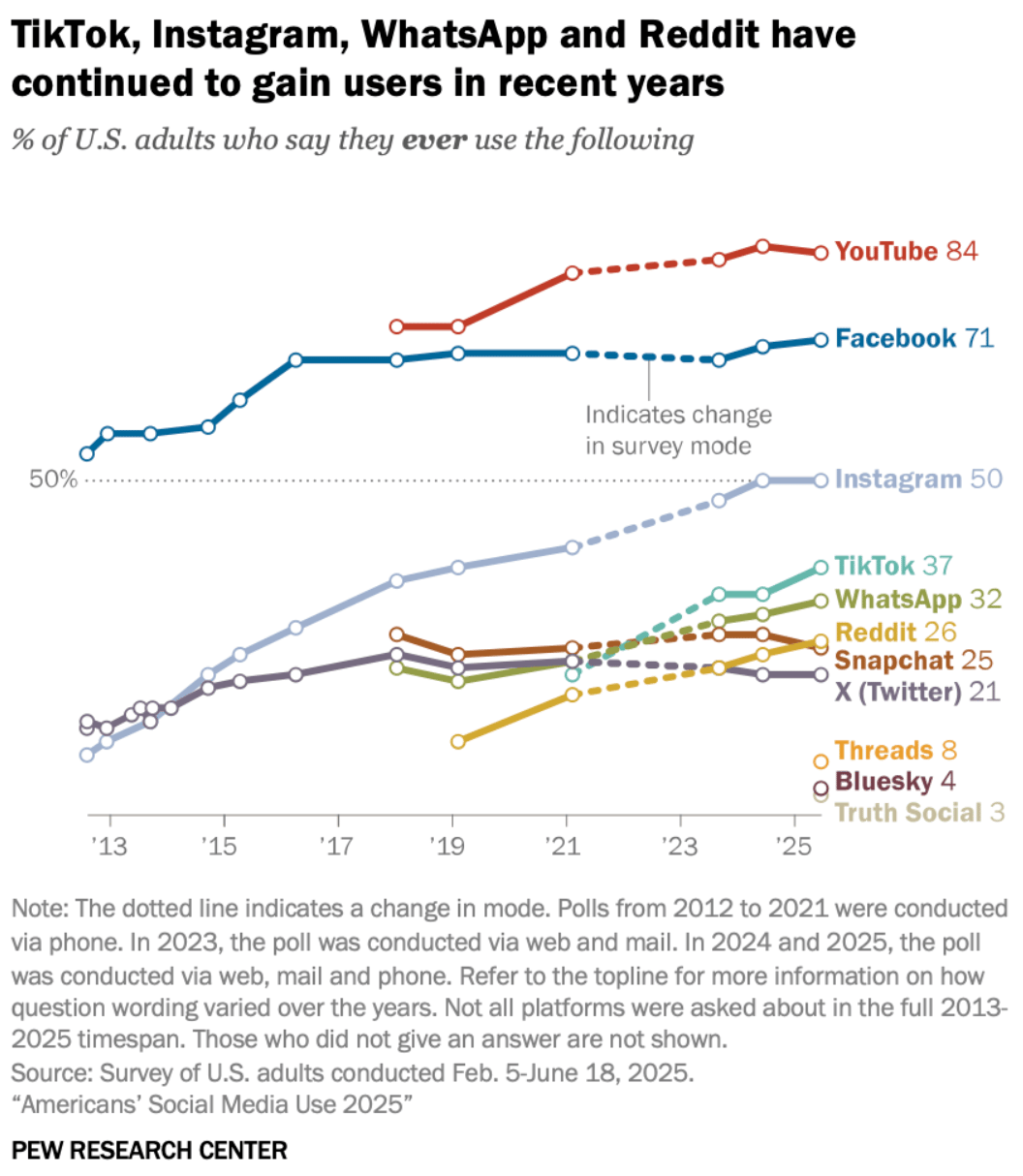

Share of adults using each platform (Pew):

1) YouTube - 84%

2) Facebook - 81%

3) Instagram - 50%

4) TikTok - 37%

5) Snap - 25%

6) X (Twitter) - 21%

Share of social media time spent watching video (Activate):

1) 2021 - 49%

2) 2022 - 60%

3) 2023 - 66%

4) 2024 - 70%

5) 2025 - 71%

Why it matters: Social is now a video-first world.

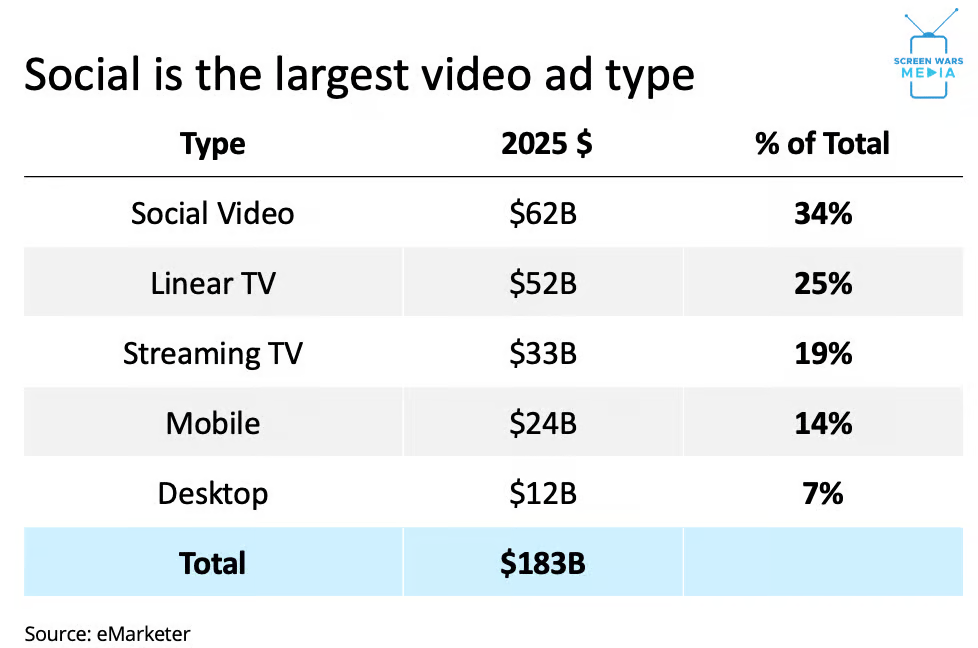

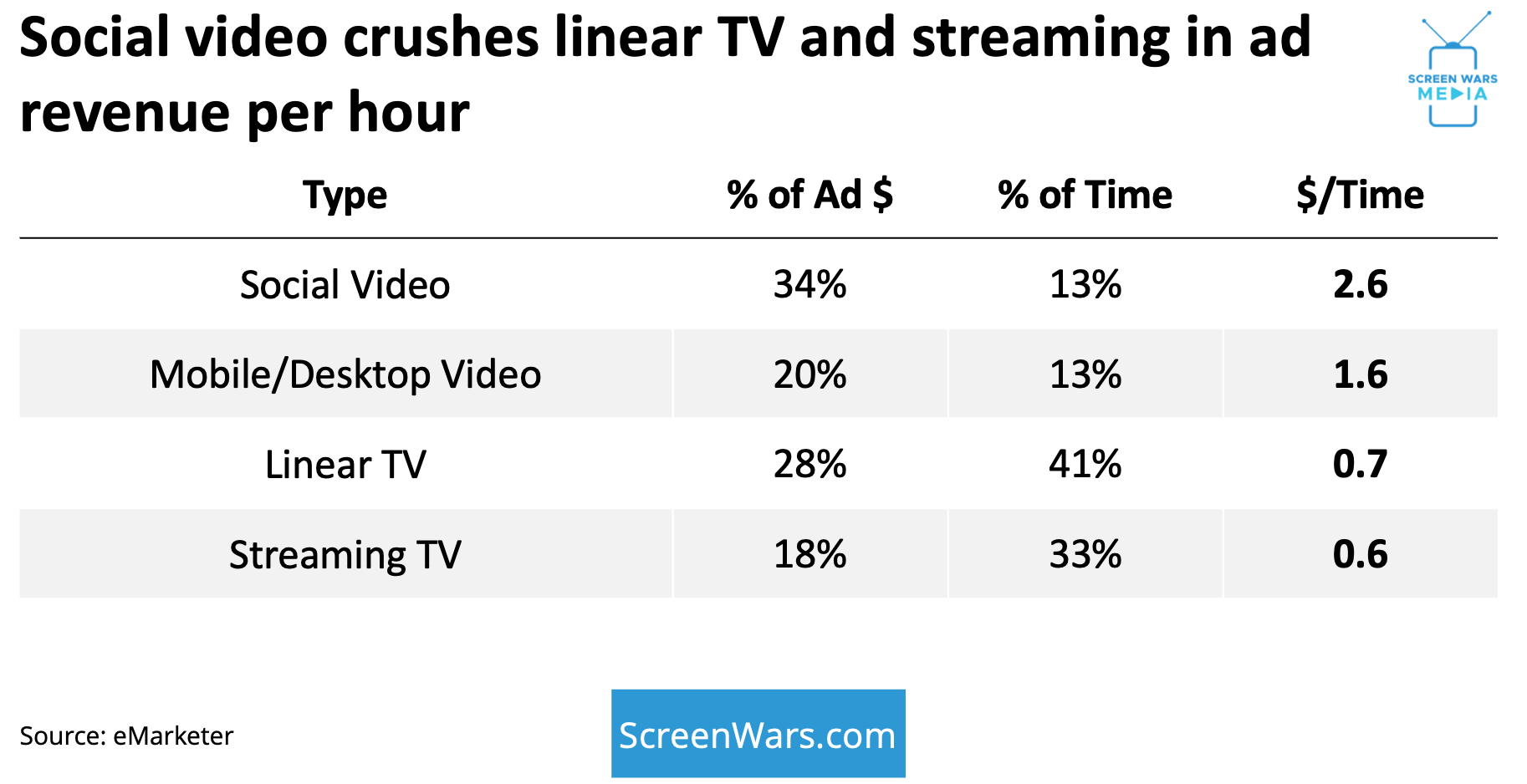

Social is the largest video ad category, making up 34% of all video ad spend.

It is also growing really fast. Even faster than streaming TV.

Flashback: Follow the Money

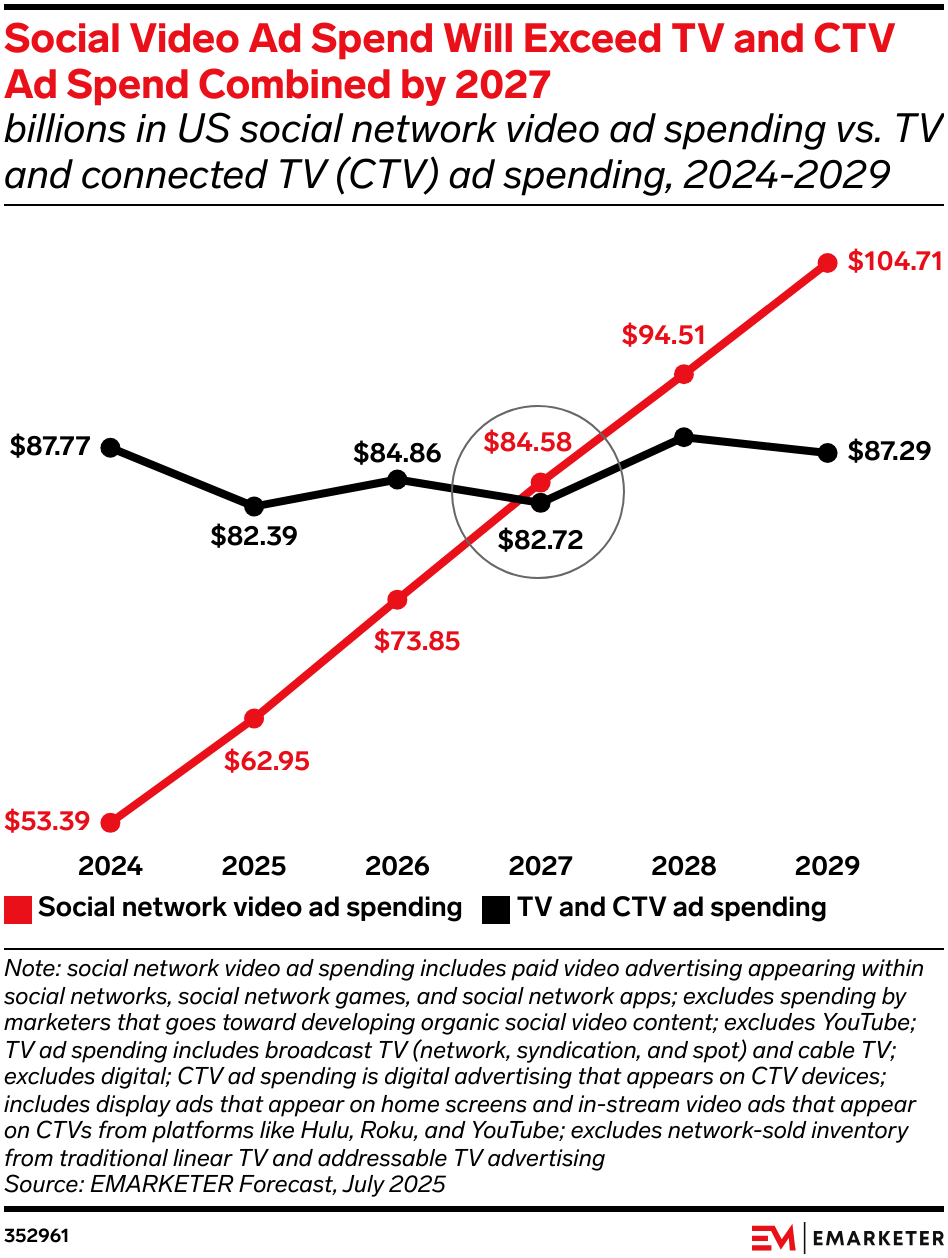

eMarketer projects that by 2027, social video ad spend will pass the combined total for linear TV and streaming.

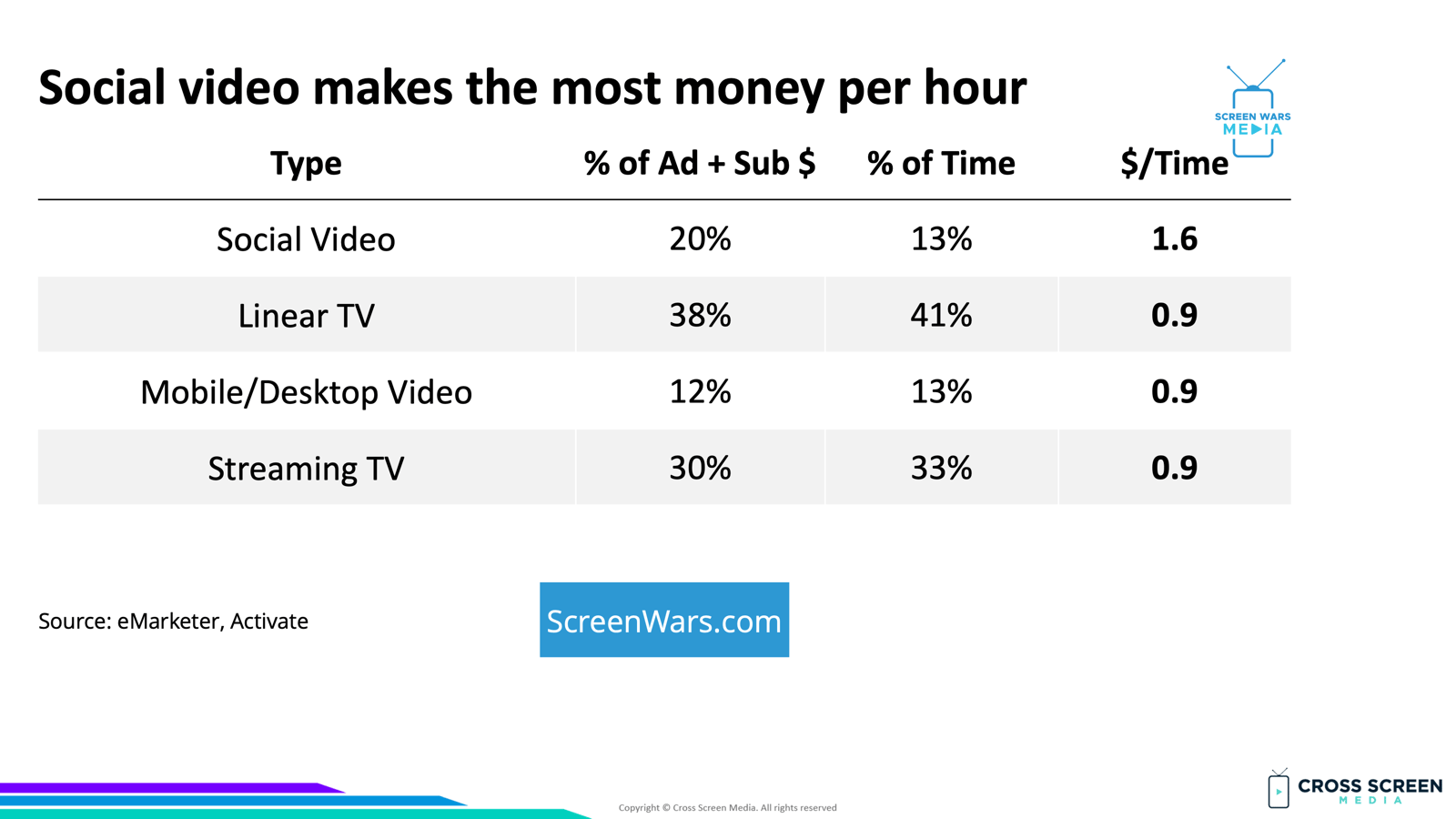

Why this matters: One hour of social video makes almost 3X more ad revenue than an hour of linear TV or streaming, and social does it with virtually no content costs.

But what about subscription revenue? Even with the $125B in subscription revenue, social video still almost doubles linear and streaming.

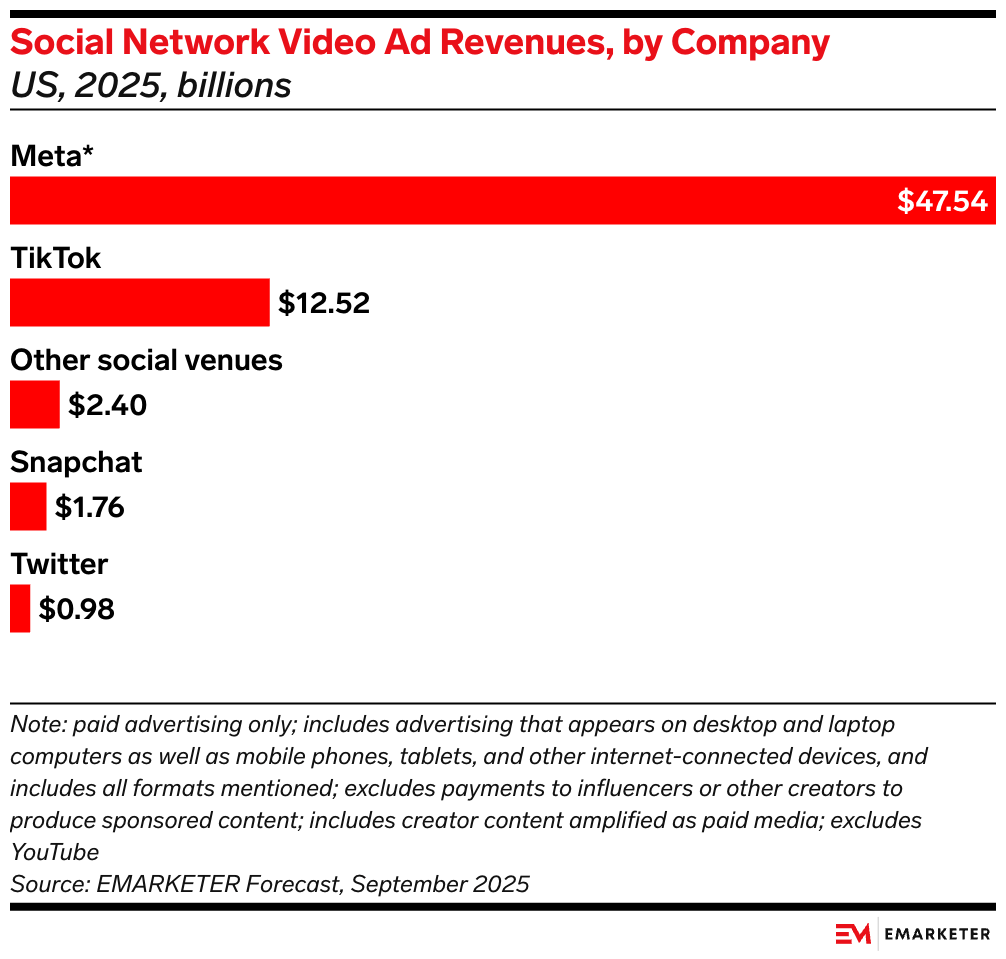

Who has the biggest video ad business?

Video ad revenue (eMarketer):

1) Meta - $48B (73%)

2) TikTok - $13B (19%)

3) Other - $2B (4%)

4) Snap - $2B (3%)

5) X (Twitter) - $1B (2%)

What happens next?

Social video is headed for the TV screen fast.

Trend #1: People Don’t Need Premium Content

Short, cheap, niche videos win attention.

This will spread to TVs, just like YouTube did.

Trend #2: Traditional Media Is Not Competitive in Algo TV

Netflix is the only non-social platform built for algorithmic video.

Legacy media only has one moat left: live events, and those rights keep getting more expensive.

Flashback #1: Sora and the Next Evolution of Algo TV

Flashback #2: The Four(ish) Horsemen of Algo TV

Trend #3: Social Platforms Have Better Economics

Targeting, measurement, and optimization are far better on social.

Advertisers follow efficiency. Always.

Reply