- State of the Screens

- Posts

- What Marshall Faulk Can Teach Us About The Screen Wars

What Marshall Faulk Can Teach Us About The Screen Wars

The most important competitive battles are rarely about strength versus strength.

They are about identifying the constraint.

The 2001 Rams entered Super Bowl XXXVI with the most explosive offense in football. They were faster, deeper, and more creative than New England. On paper, the matchup was lopsided.

The Patriots did not attempt to match that firepower. Instead, they focused on one player: Marshall Faulk.

Faulk was not simply a running back. He was the system’s fulcrum. He connected the run game to the passing game, dictated defensive personnel, and preserved offensive optionality. By disrupting Faulk, New England did not stop the Rams outright. They reduced the offense’s degrees of freedom.

The result was not domination. It was a constraint. And constraint was enough.

Television now faces a similar dynamic.

The competitive question is no longer which company has the most content, the biggest budgets, or the strongest brands. It is which companies control the system’s limiting factor.

That factor is attention.

Linear television was built on scarcity. Limited channels, fixed schedules, and habitual viewing created durable leverage. That leverage supported high margins even as audiences slowly declined.

Streaming inverts that model. Distribution is abundant. Measurement is granular. Switching costs are low. In that environment, attention cannot be assumed. It must be earned continuously.

This is why surface-level profitability is misleading. Networks can raise ad prices for a time. They can cut costs. They can bundle. But none of those tactics address the underlying problem: attention is migrating faster than linear economics can adapt.

Attention is the Marshall Faulk of the Screen Wars.

The companies that recognize this early, and reorganize around it, will define the next era of television. The ones that do not will discover that strength alone is not enough when the environment changes.

Let’s break it down into 3 big questions:

1) Where are we now?

2) Where are we heading?

3) Who wins?

Where are we now?

Today, nine companies account for 69% of all TV viewing.

Streaming-first companies are growing fast.

Linear-first companies are shrinking.

Share of TV time (Nielsen):

1) YouTube - 13%

2) Disney - 11%

3) Netflix - 9%

4) Paramount - 9%

5) NBCUniversal - 8%

6) Fox - 7%

7) WarnerBros. Discovery - 5%

8) Amazon - 4%

9) Roku Channel - 3%

10) Other - 31%

YoY growth:

1) Roku Channel - ↑ 50%

2) YouTube - ↑ 14%

3) Amazon - ↑ 7%

4) Netflix - ↑ 6%

5) NBCUniversal - ↑ 0%

6) Fox - ↓ 1%

7) Disney - ↓ 4%

8) Paramount - ↓ 7%

9) WarnerBros. Discovery - ↓ 10%

Share of TV attention from streaming:

1) YouTube - 100%

2) Netflix - 100%

3) Amazon - 100%

4) Roku Channel - 100%

5) Disney - 44%

6) Paramount - 29%

7) Fox - 29%

8) WarnerBros. Discovery - 26%

9) NBCUniversal - 21%

Known unknown: I assume the above data from Nielsen covers only the Gauge's broadcast, cable, and streaming segments. This may be incorrect. To compare these, I removed the “other category” and reapplied the share so everything adds up to 100%. I used a similar methodology for Nielsen’s ad-supported Gauge.

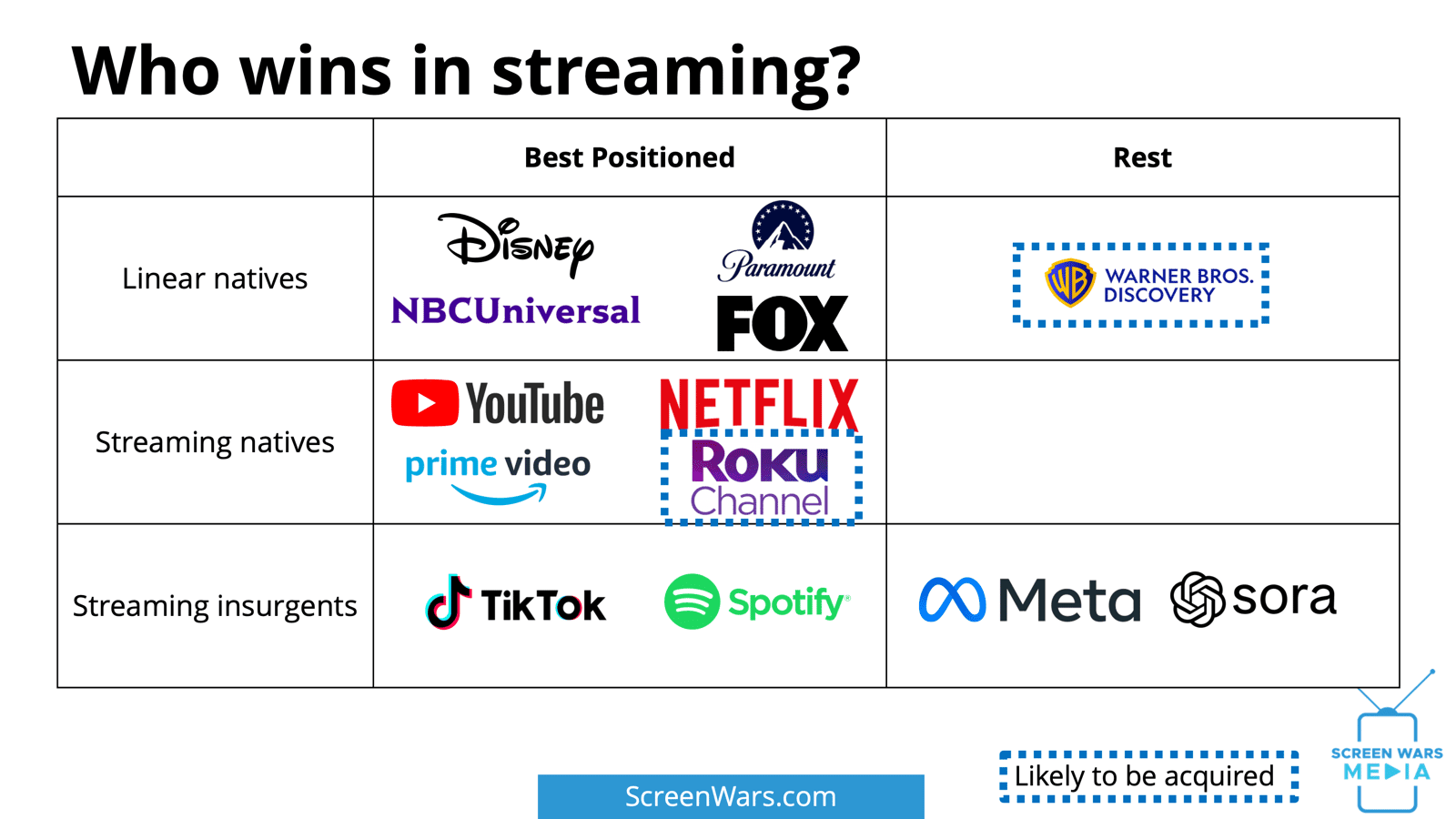

I have grouped each company into the following:

1) Linear natives - Companies attempting to move a linear TV audience to streaming

2) Streaming natives - No linear TV with a strong foothold in streaming

3) Streaming insurgents - Trying to move mobile/social audiences to streaming

Where are we heading?

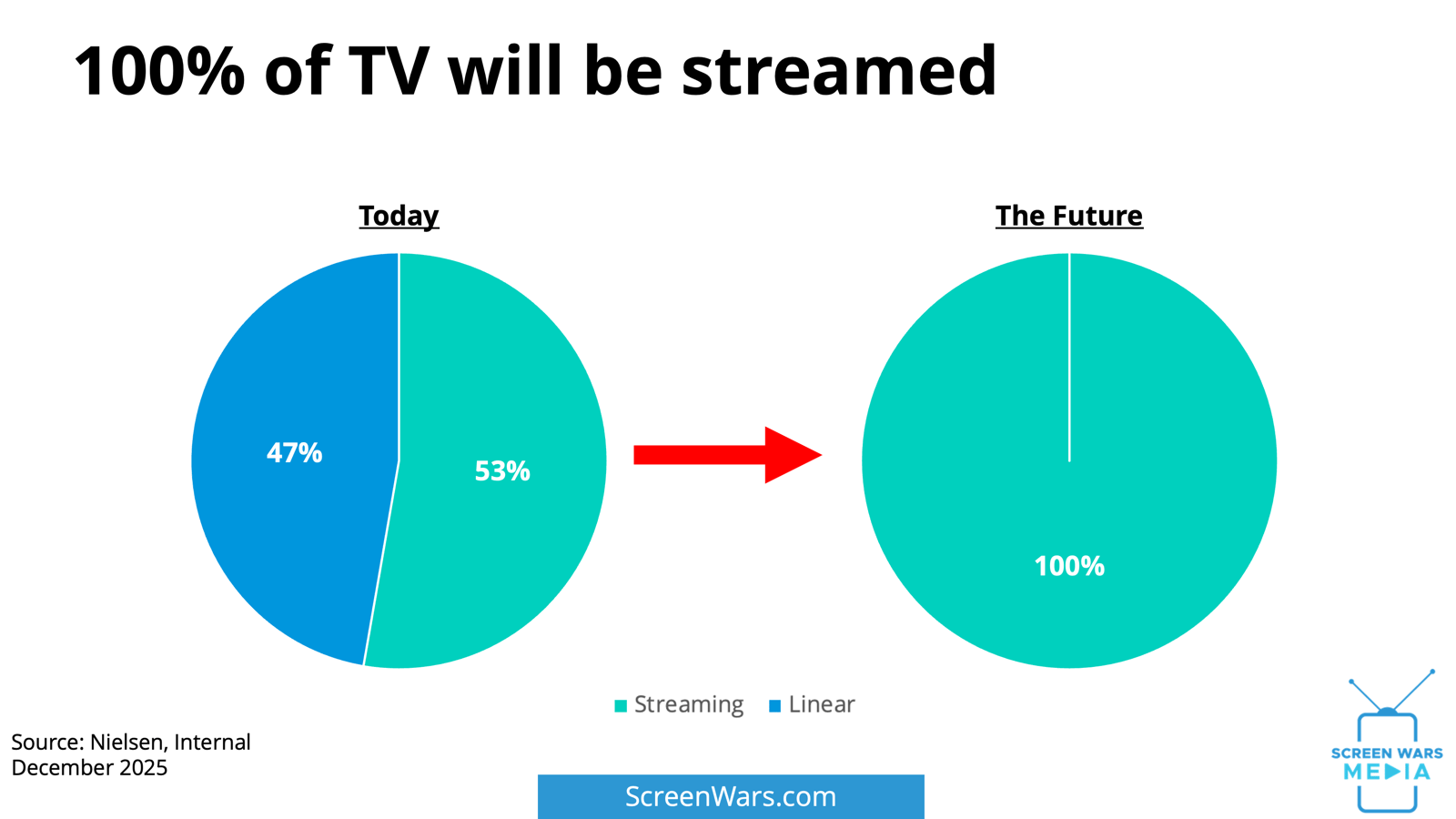

100% of TV will be streamed. The question is when?

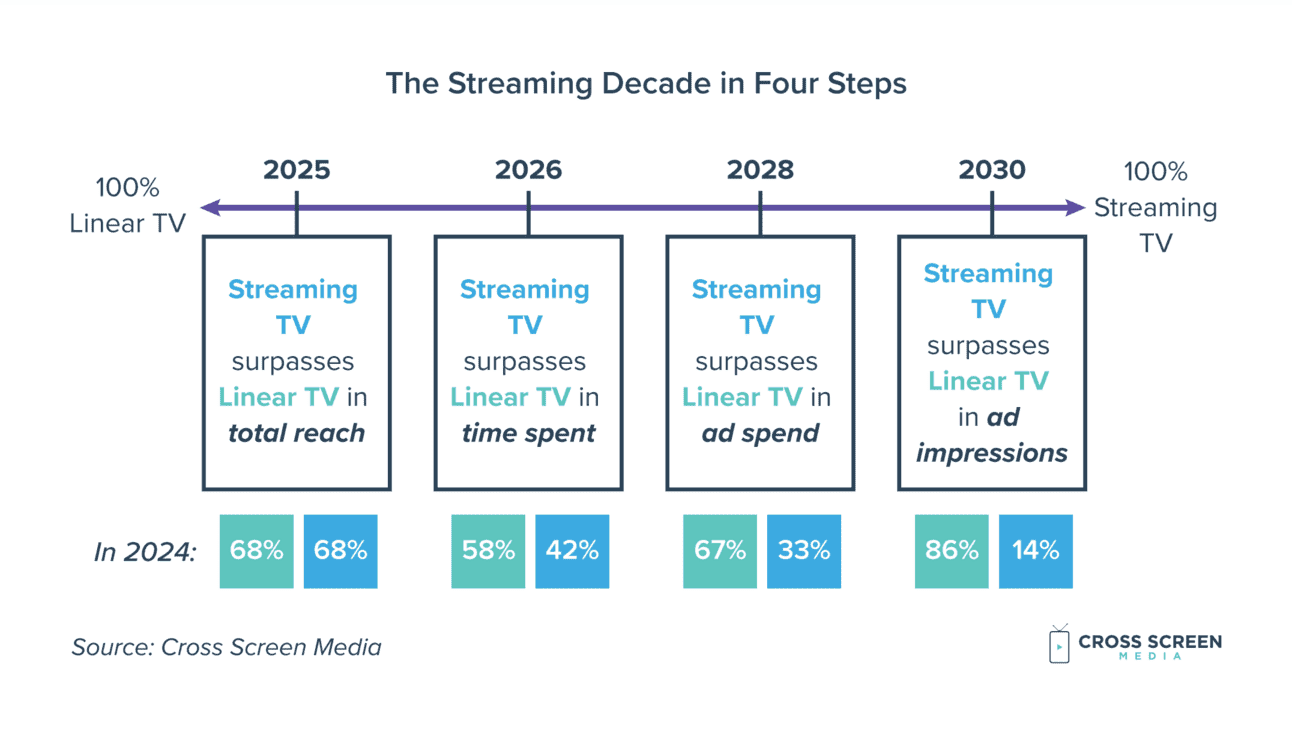

Mr. Screens in the lab: Last quarter, I released an update to my Streaming Decade in Four Steps framework. I built out a year-by-year projection through 2035 for the following:

1) Overview

2) Reach

3) Time spent

4) Ad spend

5) Ad impressions

The streaming decade in four steps:

1) 2025 - More people reachable on streaming than linear TV

2) 2026 - People spend more time on streaming than linear TV ← YOU ARE HERE

3) 2028 - Ad money flips ← 2027?

4) 2030 - Streaming gets more ad impressions than linear TV

Time spent (2025-2035):

1) Linear TV - 51% → 31% (↓ 39%)

2) Streaming TV - 49% → 69% (↑ 40%)

Flashback: How the Albanian Army Won Our Attention

Who wins?

The Screen Wars are a game of musical chairs, and there is a finite number of seats.

Here are my current picks for the ten companies that will control the convergent TV future:

1) YouTube

2) Netflix

3) Disney

4) Amazon

5) Fox

6) NBCUniversal

7) Roku Channel

8) Paramount

9) Spotify

10) TikTok

What do you think of today's newsletter? |

Reply