- State of the Screens

- Posts

- Roku Rules... For Now: Why the TVOS Wars Are Just Heating Up

Roku Rules... For Now: Why the TVOS Wars Are Just Heating Up

Then vs. now: Fifteen years ago, your TV was just a screen.

It didn’t know you. It didn’t decide what you watched. And no one in advertising cared about the software running inside it.

Now? Your smart TV is the gatekeeper to your living room — deciding what apps you see first, collecting data on everything you watch, and selling ad space that rivals entire cable networks.

In the early 2010s at Targeted Victory, I watched the set-top box rule the world. Today, TVOS rules instead. And it’s a $17B market battle that’s just getting started.

This week: the winners, losers, and what “winning” even means.

Let’s break it down into 4 big questions:

1) Which TVOS has the biggest footprint?

2) How big is the TVOS market?

3) Who’s winning the TVOS wars?

4) Why is Walmart making Vizio exclusive?

Which TVOS has the biggest footprint?

Share of smart TV OS install base in the United States, according to Kagan:

1) Roku OS (Roku) - 25%

2) Fire TV (Amazon) - 17%

3) Tizen Smart Hub (Samsung) - 14%

4) Android TV (Alphabet) - 13%

5) WebOS (LG) - 8%

6) SmartCast (Vizio) - 7%

7) Apple TVOS (Apple) - 4%

8) Xumo (Comcast/Charter) - 1%

9) Others - 9%

YoY growth rate of smart TV OS install base in the United States:

1) Xumo (Comcast/Charter) - ↑ 67%

2) Android TV (Alphabet) - ↑ 12%

3) Tizen Smart Hub (Samsung) - ↑ 9%

4) WebOS (LG) - ↑ 8%

5) SmartCast (Vizio) - ↑ 7%

6) Average - ↑ 4%

7) Fire TV (Amazon) - ↑ 4%

8) Roku OS (Roku) - ↑ 3%

9) Apple TVOS (Apple) - ↑ 0%

10) Other - ↓ 16%

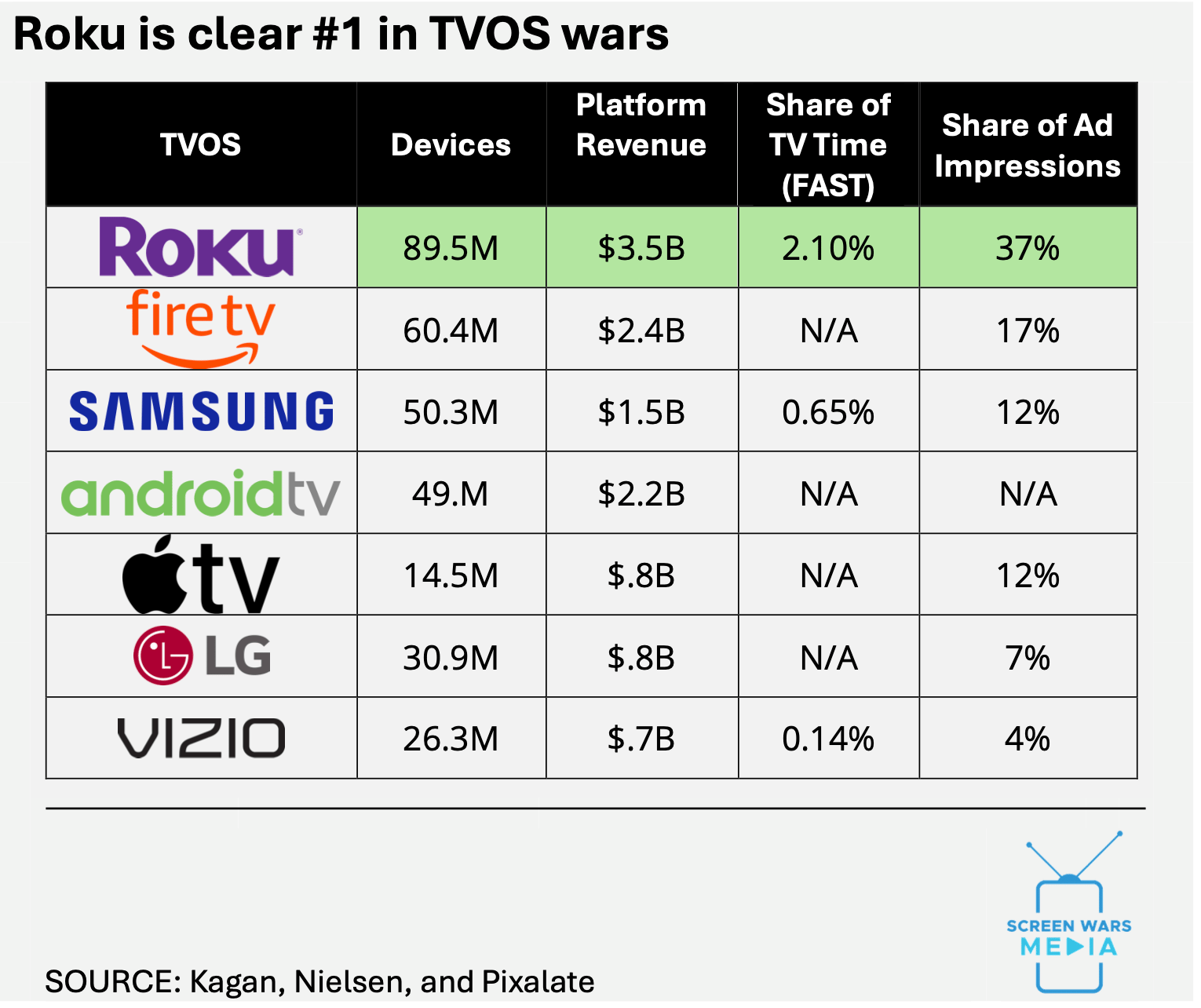

Share of streaming TV ad impressions according to Pixalate:

1) Roku - 37%

2) Fire TV - 17%

3) Samsung - 12%

4) Apple - 12%

5) LG - 7%

6) Vizio - 4%

7) Other - 11%

How big is the TVOS market?

U.S. TVOS market by type, according to Kagan:

1) Advertising - $10.1B (61%)

2) Services - $5.2B (31%)

3) Other - $1.4B (8%)

4) Total - $16.6B

U.S. TVOS platform revenue by company:

1) Roku OS (Roku) - $3.5B (25%)

2) Fire TV (Amazon) - $2.4B (17%)

3) Android TV (Alphabet) - $2.2B (15%)

4) Tizen Smart Hub (Samsung) - $1.5B (11%)

5) Apple TVOS (Apple) - $763M (5%)

6) WebOS (LG) - $759M (5%)

7) SmartCast (Vizio) - $738M (5%)

8) Xumo (Comcast/Charter) - $189M (1%)

9) Other - $2.4B (17%)

Who’s winning the TVOS wars?

Roku sweeps:

#1 in devices

#1 in platform revenue

#1 in free ad-supported TV time (FAST)

#1 in ad impressions

Why is Walmart making Vizio exclusive?

Walmart sells 55% of U.S. smart TVs, including 3M - 4M ONN house-brand TVs, now switching from Roku to Vizio SmartCast.

Why it matters:

1) Walmart needs a bigger SmartCast base to make Vizio’s ad/data business pay off.

2) But making Vizio exclusive limits distribution — and growth.

Share of smart TVs sold at Walmart by brand according to LightShed Partners:

1) ONN - 3M - 4M (35%)

2) Everyone else - 6M - 7M (65%)

3) Total - 10M

Quote from Lightshed Partners:

“The Vizio acquisition’s true value lies in SmartCast’s potential as an advertising and data platform. To justify the purchase price, Walmart needs a substantially larger SmartCast installed base than Vizio’s current footprint. However, the exclusivity strategy introduces a fundamental tension: limiting retail distribution inherently constrains platform growth. Walmart’s decision, while strategically suboptimal, was effectively inevitable once competitors began deprioritizing Vizio. The company now faces the challenge of driving significant volume through its own channels to achieve the scale economics that made the acquisition compelling in the first place.”

Vizio’s share of U.S. smart TV operating systems:

1) 2019-Q1 - 3%

2) 2020-Q1 - 4%

3) 2021-Q1 - 6%

4) 2022-Q1 - 6%

5) 2023-Q1 - 7%

6) 2024-Q1 - 7%

7) 2025-Q1 - 7%

Bottom line: TVOS is the front door to your living room. The winner gets the data, the ads, and the power to shape what you watch.

What do you think of today's newsletter? |

Reply