- State of the Screens

- Posts

- Can Streaming Win Gold in 2026?

Can Streaming Win Gold in 2026?

The Olympics kick off today.

And with them, NBC enters what might be the most concentrated stretch of premium sports programming left on American TV.

The Super Bowl.

The Olympics.

The NBA All-Star Game.

Three events built for mass audiences.

All happening in the same month.

All are increasingly watched in different ways.

Viewership looks flatter.

Streaming is poised for growth.

And the economics keep working anyway.

That shouldn’t be possible.

But it is.

Which raises a set of questions worth asking, not about sports, but about media.

Let’s break it down into 4 big questions:

1) How many people actually watch the Olympics?

2) What share of Olympic viewing comes from streaming?

3) Why does NBCUniversal pay so much for the Olympics?

4) How much advertising revenue will NBCUniversal generate from the Olympics?

How many people actually watch the Olympics?

More than 2B people watched the 2022 Beijing Games.

Winter Olympics (global) total viewers:

1) 2010 (Vancouver) - 1.8B

2) 2014 (Sochi) - 2.1B (↑ 17%)

3) 2018 (PyeongChang) - 1.9B (↓ 9%)

4) 2022 (Beijing) - 2.0B (↑ 5%)

Winter Olympics (global) minutes viewed:

1) 2018 (PyeongChang) - 604B

2) 2022 (Beijing) - 713B (↑ 5%)

Quick math on how much time we spend watching the Olympics:

1) 2B watched 2022 games

2) 713B total minutes of viewing

3) 355 minutes (6 hours) per viewer

Positive sign: The average minutes viewed increased 18% (315m → 355m) between the 2018 and 2022 games.

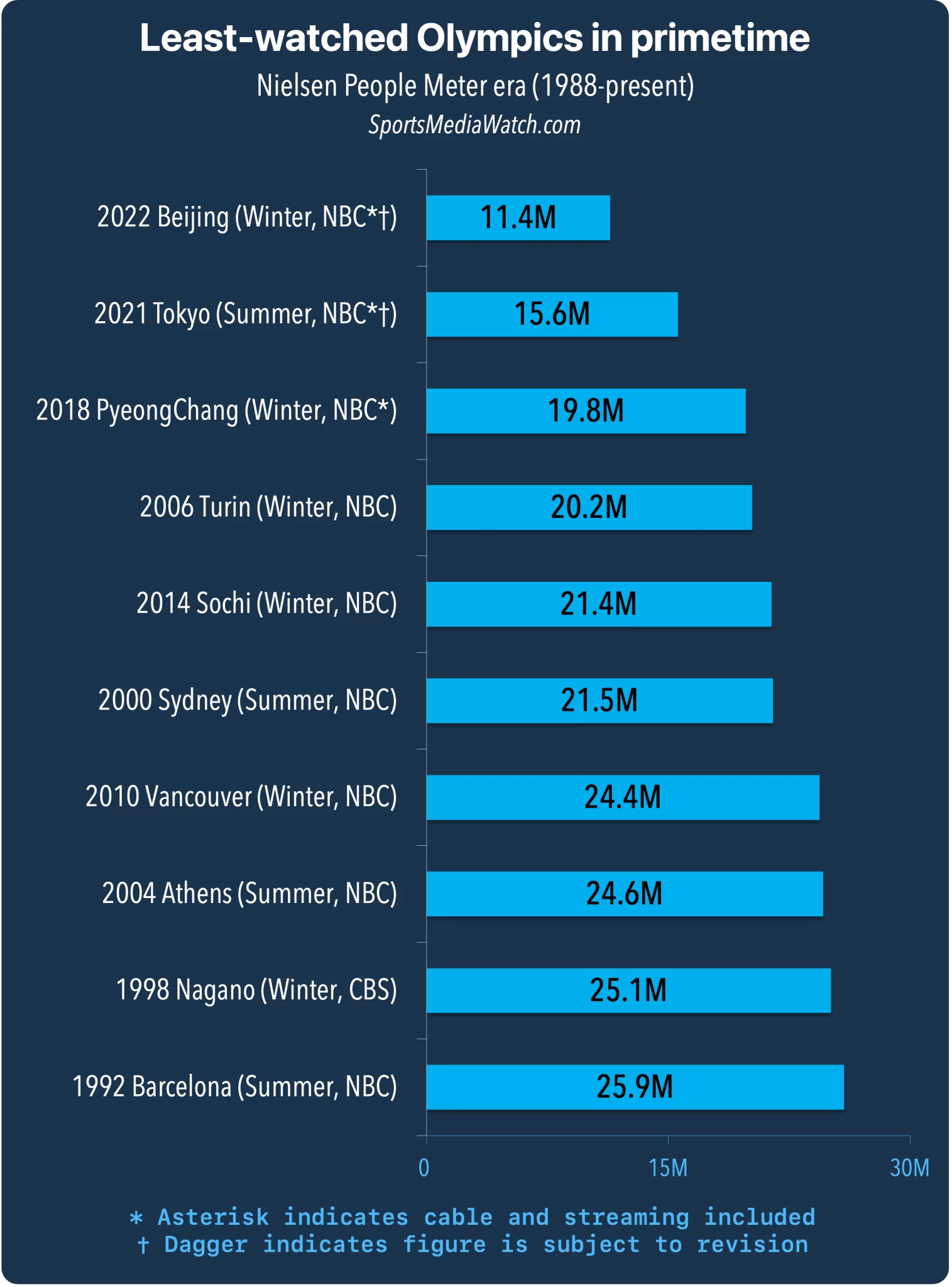

Winter Olympics (U.S. only) average primetime viewership (Nielsen):

1) 1992 (Albertville) - 29M

2) 1994 (Lillehammer) - 43M (↑ 49%)

3) 1998 (Nagano) - 25M (↓ 42%)

4) 2002 (Salt Lake) - 32M (↑ 27%)

5) 2006 (Torino) - 20M (↓ 37%)

6) 2010 (Vancouver) - 24M (↑ 21%)

7) 2014 (Sochi) - 21M (↓ 13%)

8) 2018 (PyeongChang) - 20M (↓ 7%)

9) 2022 (Beijing) - 11M (↓ 42%)

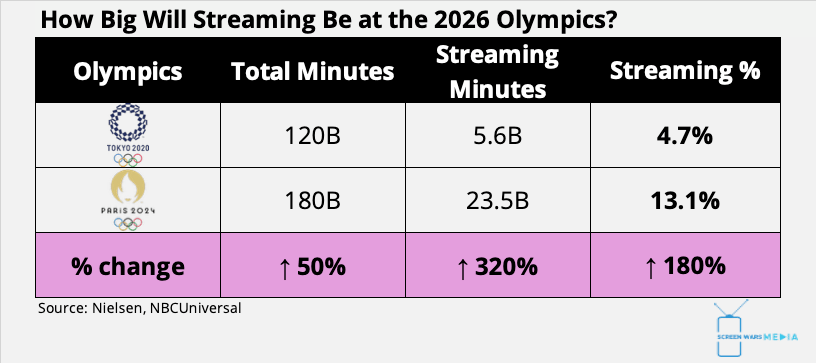

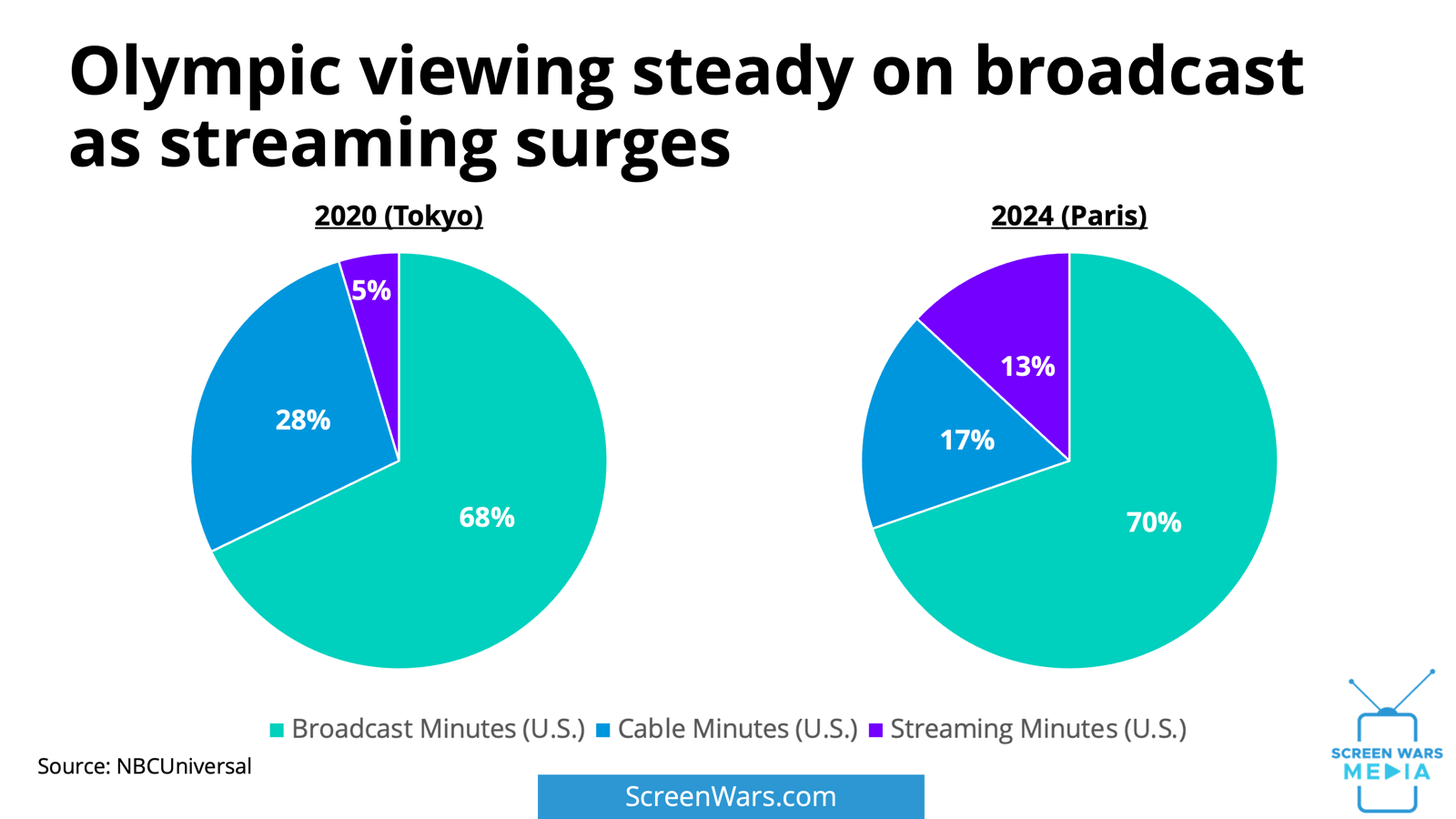

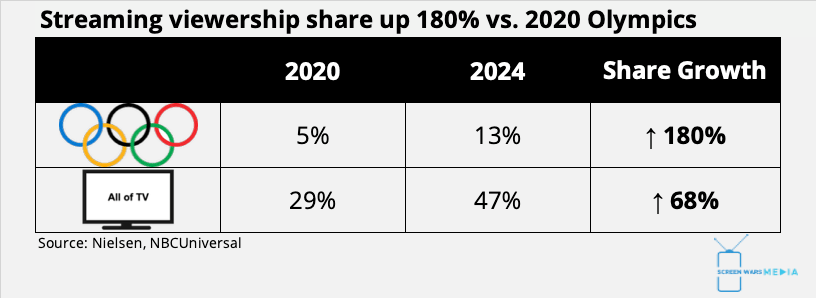

In 2020, streaming represented roughly 5% of U.S. Olympic viewing.

By 2024, that figure had risen to 13%.

That is a 180% increase in share in a single Olympic cycle.

How we watched (2020 vs. 2024):

1) Broadcast - 68% → 70%

2) Cable - 28% → 17%

3) Streaming - 5% → 13%

Importantly, broadcast has remained stable. Cable has absorbed nearly all of the decline. Streaming is not stealing viewers from broadcast; it is replacing the middle layer.

This mirrors the broader TV transition almost exactly, with one key difference:

Sports are several years behind.

Streaming reached 13% of total TV viewing in 2017. Sports reached that same level in 2024. The implication is straightforward: sports are not resisting streaming, they are following it on a lag.

For NBCUniversal, this lag is a feature, not a bug. It allows Peacock to scale without undermining the broadcast cash machine.

FYI: NBCUniversal gets 21% of its viewing time from streaming.

Why does NBCUniversal pay so much for the Olympics?

Because the U.S. viewer is absurdly valuable.

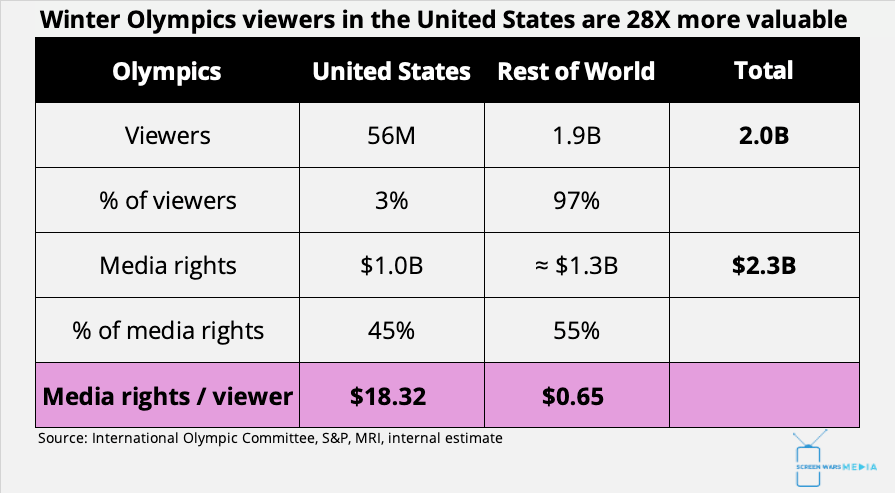

NBCUniversal will pay roughly $1B for U.S. rights to the 2026 Winter Games. The U.S. represents only 4% of the global population, yet accounts for roughly 45% of global media rights revenue.

On a per-viewer basis, the math is stark:

1) A U.S. Olympic viewer is worth $18 in media rights

2) A non-U.S. Olympic viewer is worth $0.65

That is a 28X difference.

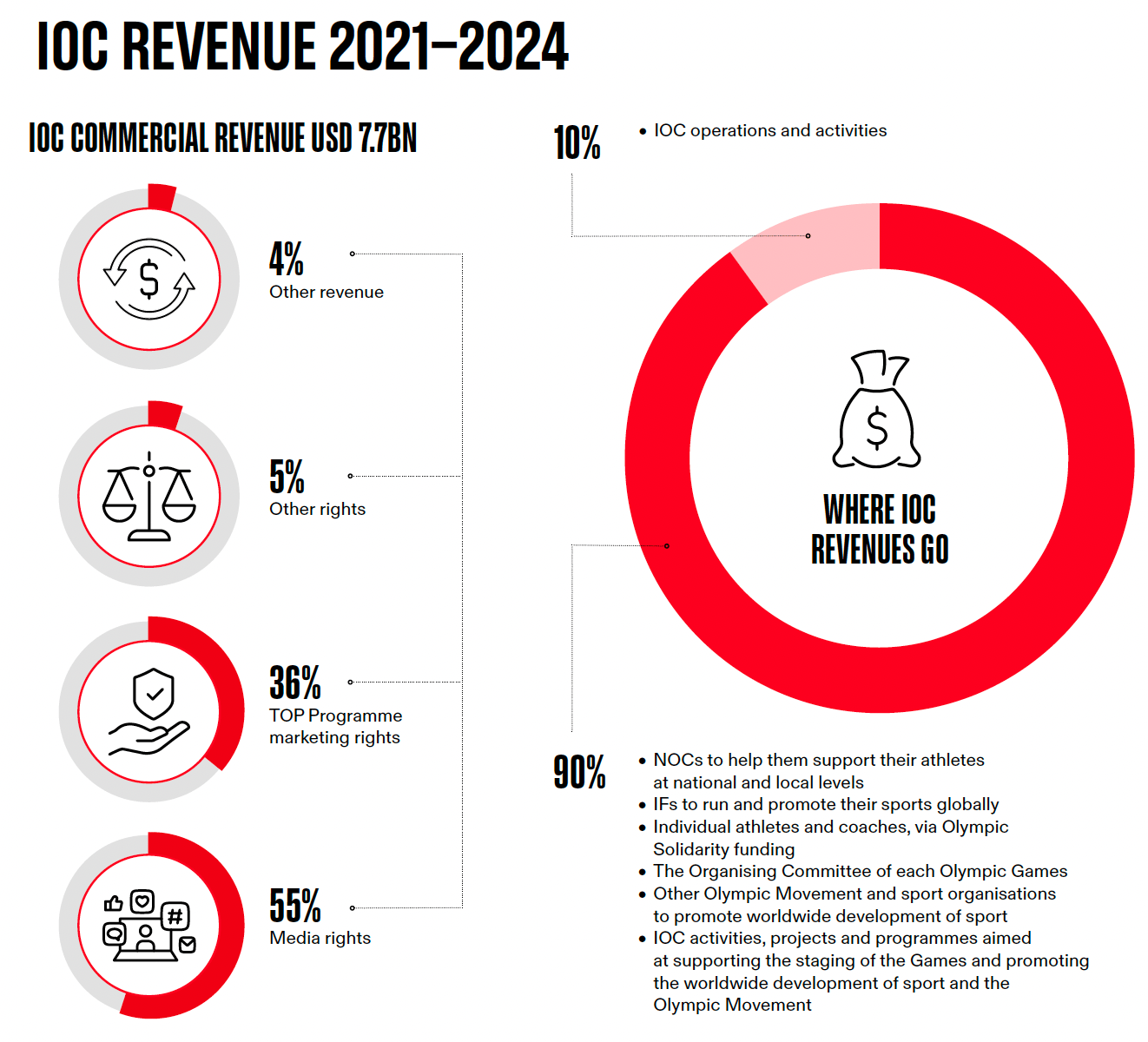

Just like other sports, media rights make up the largest source of revenue (55%).

How much advertising revenue will NBCUniversal generate from the Olympics?

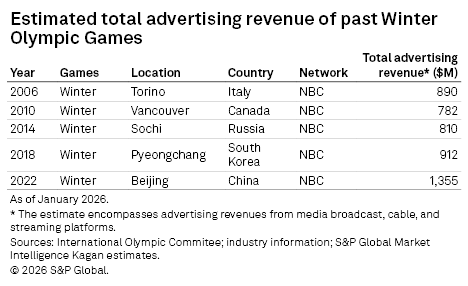

Winter Olympics ad spend (Kagan):

1) 2006 (Torino) - $890M

2) 2010 (Vancouver) - $782M (↓ 12%)

3) 2014 (Sochi) - $810M (↑ 4%)

4) 2018 (PyeongChang) - $912M (↑ 13%)

5) 2022 (Beijing) - $1.4B (↑ 49%)

What do you think of today's newsletter? |

Reply